|

Trading System API

3.0

Library for Simulating and Deploying Trading and Investment Strategies

|

|

Trading System API

3.0

Library for Simulating and Deploying Trading and Investment Strategies

|

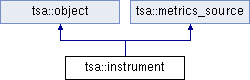

Class instrument represents a tradeable security such as a stock, option, futures contract, currency, etc. Class instrument combines data-access with functionality for placing orders and managing positions. More...

#include <TSAInstrument.h>

Public Member Functions | |

| void | allow_null_values (bool flag) |

| Determines whether any incoming stream data is allowed to have 'null' ('N/A') values. If set to true, it is up to the user to explicitly check each value before using it. To check for null, values must be accessed as variants, not via auto-series. Use the variant::defined() member do check if the value is not null. More... | |

| bool | allow_null_values (void) const |

| Returns true if 'null' values are allowed in incoming stream data. More... | |

| const std::vector< trade_info > & | closed_trades (void) const |

| Returns information on all closed out trades. | |

| double | current_drawdown (void) const |

| Returns the size of the current equity drawdown for this instrument. If the strategy trades multiple instruments then each instrument will have its own drawdown measure. More... | |

| const std::vector< trade_leg > & | current_trade_legs (void) const |

| Returns a container with the current trade's 'legs'. More... | |

| const std::vector< transaction > & | get_bar_transactions (void) const |

| Returns a reference to a vectors containing the transactions that occured during the current bar. More... | |

| void | set_next_bar (const date_time &, double o, double h, double l, double c, double v) |

| Manually sets the next bar timestamp and ohlcv prices. Useful for writing test code. More... | |

Public Member Functions inherited from tsa::object Public Member Functions inherited from tsa::object | |

| object (void) | |

| Constructor. | |

| virtual | ~object (void) |

| Destructor. | |

| const char * | class_name (void) const |

| Returns the class name as returned by the 'Real Time Type Information' (RTTI) mechanism. More... | |

| bool | has_same_class_as (const object &other) const |

| Returns true if self has the same type as other object. More... | |

Constructors / Destructor | |

| instrument (void) | |

| Constructor. | |

| ~instrument (void) | |

| Destructor. | |

Identification | |

| size_t | id (void) const |

| Returns the instrument ID. Each instrument is assigned a unique number starting at zero. | |

| bool | is_platform_driven (void) const |

| Returns true if the strategy is attached to a platform_proxy or net::socket_base derived object. More... | |

| bool | is_live (void) const |

| Strategies driven by 'live' data can be started on 'backfill' data. Once the strategy has worked through the backfill records, it calls strategy::on_live() from which point onward the strategy switches to 'live' data and instrument::is_live() returns true. More... | |

| bool | exception_on_backfill_orders (void) const |

| void | name (const std::string &name) |

| Sets the instrument name. More... | |

| const std::string & | name (void) const |

| Returns the instrument name. More... | |

Data Stream | |

| void | as_random_walk (duration bar_duration=duration::days(1)) |

| Tells the instrument to generate its own random walk sequence with intervals of bar_duration. More... | |

| void | connect (const std::string &stream_name, const std::string &database_name="default") |

| Sets the given stream as the instrument's data source. More... | |

| std::string | stream_name (void) const |

| Returns the name of the data stream to which the instrument is connected. More... | |

| std::string | data_base_name (void) const |

| void | connect (in_stream_adaptor &adaptor) |

| Connects this instrument object to the given in-stream-adaptor. | |

| date_time | begin () |

| Returns the timestamp of the first record in the datasource to which this object is connected. More... | |

| date_time | end () |

| Returns the timestamp of the last record in the datasource to which this object is connected. More... | |

| const series_core & | operator() (size_t field_pos) const |

| From records streamed from the data source this member returns the series corresponding to the given field_pos. More... | |

| const series_core & | operator() (const std::string &field_name) const |

| From records streamed from the data source this member returns the series corresponding to the given field_name. More... | |

| size_t | field_count (void) const |

| Returns the number of fields in records streamed from the connected datasource. More... | |

| date_time | record_timestamp (void) const |

| Returns the timestamp of the current record. More... | |

| bool | field_exists (const std::string &field_name) const |

| Returns true if a field with the given field_name exists in records coming from the data-source. More... | |

| size_t | field_index (const std::string &field_name) const |

| Return the zero based position of the field that has the given field_name. More... | |

| tsa::type_t | field_type (const std::string &field_name) const |

| Returns the field type of the field with the given field_name. More... | |

Auto Series | |

| series< double > | open |

| Built in series object corresponding to record field 'open'. | |

| series< double > | high |

| Built in series object corresponding to record field 'high'. | |

| series< double > | low |

| Built in series object corresponding to record field 'low'. | |

| series< double > | close |

| Built in series object corresponding to record field 'close'. | |

| series< double > | volume |

| Built in series object corresponding to record field 'volume'. | |

| series< double > | bid |

| Built in series object corresponding to record field 'bid'. | |

| series< double > | ask |

| Built in series object corresponding to record field 'ask'. | |

| series< double > | bidsize |

| Built in series object corresponding to record field 'bidsize'. | |

| series< double > | asksize |

| Built in series object corresponding to record field 'asksize'. | |

| series< double > | last |

| Built in series object corresponding to record field 'last'. | |

| series< double > | price |

| Built in series object corresponding to record field 'price'. | |

| series< double > | value |

| Built in series object corresponding to record field 'value'. | |

| series< double > | openint |

| Built in series object corresponding to record field 'openint'. | |

Settings | |

| void | negative_prices_ok (bool neg_prices_ok) |

| Sets a flag which if 'true' allows negative prices in fields 'open', 'high', 'low', 'close'. More... | |

| bool | negative_prices_ok (void) const |

| Returns true if negative prices are tolerated during strategy evaluation. More... | |

| double | big_point (void) const |

| The value (in local currency) of a 1 point change in the instrument's price. This calculated as follows: big_point_value = (1.0 / min_tick) * tick_value;. More... | |

| void | tick (double min_tick, double tick_value, bool auto_round=true) |

| Sets the value of the 'minimum tick' (the smallest possible price change for a given traded security) as well as the tick's cash value. More... | |

| double | tick_size (void) const |

| Returns the value of the smallest allowed price change (min_tick) as set via the tick() member. More... | |

| double | tick_value (void) const |

| Returns the cash value of the min_tick as set by via the tick() member. More... | |

| double | ticks (int64_t multiplier) const |

| Returns the price equivalent of a price tick multiplied by the given multiplier. More... | |

| void | limit_fill_proviso (double proviso) |

| Sets the 'limit fill proviso'. This value determines by what margin market prices must exceed a limit price for a limit order to be assumed filled as part of a simulation. This value can help make simulations more realistic. More... | |

| double | limit_fill_proviso (void) const |

| Returns the 'limit fill proviso'. More... | |

| void | slippage (double slip) |

| Sets the 'per side' or 'per transaction' slippage (by default it is interpreted as 'per-side' slippage. This can be changed via the cost_allocation() member). A realistic slippage setting helps make simulations more realistic by accounting for non-optimal fills. Slippage is only counted for stop and market orders. Limit orders never have slippage regardless of the slippage setting. Slippage can be reset during strategy evaluations to account for changes in volatility. More... | |

| double | slippage (void) const |

| Returns the slippage as set via the slippage(double slip) member. More... | |

| void | commission (double comm) |

| Sets the per-side / per-unit commission. Commission is allocated on a per-unit basis (the default) or on a per-transaction basis depending on what was set via the cost_allocation() member. More... | |

| double | commission (void) const |

| Returns the value set via the instrument::commission(double) member which is zero by default. More... | |

| void | cost_allocation (cost_alloc_type t) |

| Sets the cost-allocation type that affects how commission and slippage are accounted for during simulations. Valid values are: More... | |

| bool | costs_allocated_per_unit (void) const |

| Returns true if the cost allocation is set to 'per_unit' (the default). Returns false if 'per_transaction'. More... | |

Order Properties | |

| std::string | platform (void) const |

| Returns the name of the excution platform / broker. | |

| instrument & | platform (const std::string &platform_name) |

| Sets the name of the excution platform / broker. Note that different instrument objects can trade via different brokers. More... | |

| std::string | broker (void) const |

| Same functionality as platform() member. | |

| instrument & | broker (const std::string &broker_name) |

| Same functionality as platform(const std::string& platform_name) member. More... | |

| std::string | feed (void) const |

| Returns the name of the data feed to which the instrument is connected. More... | |

| std::string | interval (void) const |

| Returns the interval (bar) type and duration. Valid values look like '5MIN', '1SEC', '3TICK'. More... | |

| instrument & | define (const std::string &symbol, const std::string &exchange, const std::string &platform) |

| Use this member to identify the instrument. This is required for live trading via the server. More... | |

| instrument & | symbol (const std::string &symb) |

| Sets the instrument's symbol. Use the define() member instead unless you have a special requirement. More... | |

| const std::string & | symbol (void) const |

| Returns the symbol. It would return 'ES' even if 'ES:DEC15' was passed to the define() member. | |

| instrument & | expiry (const std::string &expiry) |

| Sets the contract expiry. Use the define() member instead to pass a symbol-expiry combination like 'ES:DEC15', unless you have a special requirement. More... | |

| const std::string & | expiry (void) const |

| Returns the contract expiry like 'DEC15'. More... | |

| const std::string & | expiry_yyyymm (void) const |

| Returns the contract expiry in yyyymm format like: 201512. More... | |

| std::string | instrument::type (void) const |

| Returns the instrument type like 'STK' or 'FUT'. More... | |

| instrument & | exchange (const std::string &exch) |

| Sets the instrument's exchange. Use the define() member instead unless there is a special requirement. More... | |

| const std::string & | exchange (void) const |

| Returns the instrument's exchange. More... | |

| instrument & | currency (const std::string &ccy) |

| Sets the instrument's currency. More... | |

| const std::string & | currency (void) const |

| Returns the instrument's currency. More... | |

Orders Creation and Transmission | |

The following member functions allow the creation and management of orders to buy and sell instruments on an exchange. Orders are sent off immediately unless the function name has an '_order' suffix, in which case the function returns an order_ref instance, refering to an unsent order, on which various properties can be modified before the order is sent by calling order_ref::send() member. Note that some properties, such as the one set by the order::tag() member, can still be changed even after an order has been sent to the exchange. This is so because the order 'tag' is not relevant to the exchange or broker. All properties relevant to order execution must be set before the order is sent. | |

| void | default_time_in_force (order::time_in_force default_tif) |

| Sets the default time-in-force, which determines order lifetime. More... | |

| order_ref | buy (quantity_t quantity) |

| Creates and immediately sends an order to buy 'at market' a given quantity of securities. More... | |

| order_ref | buy (quantity_t quantity, double fixed_fill_price) |

| order_ref | buy_order (quantity_t quantity) |

| Creates an order, without sending it, to buy 'at market' a given quantity of securities. More... | |

| order_ref | sell (quantity_t quantity) |

| Creates and immediately sends an order to sell 'at market' a given quantity of securities. More... | |

| order_ref | sell (quantity_t quantity, double fixed_fill_price) |

| order_ref | sell_order (quantity_t quantity) |

| Creates, without sending, an order to sell 'at market' a given quantity of securities. More... | |

| order_ref | buy_stop (quantity_t quantity, double stop_price) |

| Creates and immediately sends an order to buy a given quantity of securities at a the given stop_price. More... | |

| order_ref | buy_stop_order (quantity_t quantity, double stop_price) |

| Creates, without sending, an order to buy a given quantity of securities at the given stop_price. More... | |

| order_ref | sell_stop (quantity_t quantity, double stop_price) |

| Creates and immediately sends an order to sell a given quantity of securities at a the given stop_price. More... | |

| order_ref | sell_stop_order (quantity_t quantity, double stop_price) |

| Creates, without sending, an order to sell a given quantity of securities at the given stop_price. More... | |

| order_ref | buy_stop_limit (quantity_t quantity, double stop_price, double price_limit) |

| Creates and immediately sends an order to buy a given quantity of securities at the given stop_price with the given price_limit. More... | |

| order_ref | buy_stop_limit_order (quantity_t quantity, double stop_price, double price_limit) |

| Creates, without sending, an order to buy a given quantity of securities at the given stop_price with given price_limit. More... | |

| order_ref | sell_stop_limit (quantity_t quantity, double stop_price, double price_limit) |

| Creates and immediately sends an order to sell a given quantity of securities at the given stop_price with the given price_limit. More... | |

| order_ref | sell_stop_limit_order (quantity_t quantity, double stop_price, double limit_price) |

| Creates, without sending, an order to sell a given quantity of securities at the given stop_price with given price_limit. More... | |

| order_ref | buy_limit (quantity_t quantity, double limit_price) |

| Creates and immediately sends an order to buy a given quantity of securities at a the given limit_price. More... | |

| order_ref | buy_limit_order (quantity_t quantity, double limit_price) |

| Creates, without sending, an order to sell at given limit_price a given quantity of securities. More... | |

| order_ref | sell_limit (quantity_t quantity, double limit_price) |

| Creates and immediately sends an order to sell at given limit_price a given quantity of securities. More... | |

| order_ref | sell_limit_order (quantity_t quantity, double limit_price) |

| Creates, without sending, an order to sell at given limit_price a given quantity of securities. More... | |

Order Management | |

| void | cancel_all_orders (void) |

| Cancels all 'active' orders owned by this instrument. | |

| void | cancel_order (identifier_t id) |

| Cancels the order with t given order id. More... | |

| bool | order_exists (identifier_t id) const |

| Returns true if an order with the given id exists. More... | |

| void | get_orders (std::vector< order_ref > &v, bool active_only=true) const |

| Populates vector v with either all or only the 'active' orders depending on the given active_only flag. More... | |

| bool | has_active_orders (void) const |

| Checks if this instrument object has 'active' orders. More... | |

| void | get_active_orders (std::vector< order_ref > &v, order::type _ot, order::action) const |

| Populates vector v with all 'active' orders. More... | |

| order_ref | get_order (identifier_t id) const |

| Returns an order with given id. More... | |

| order * | get_order_ptr (identifier_t id) const |

| Returns a pointer to the order with given id. Note that it is unusual to access an order object directly. Normally orders should be handled via order_ref objects. More... | |

| size_t | order_count (void) const |

| Returns the number of 'active' orders. More... | |

| size_t | order_count_inclusive () const |

| Returns the number of orders, both 'active' and 'inactive'. Inactive orders may be marked for deletion. More... | |

Position and Profitability | |

| double | net_profit (void) const |

| Returns the cumulative net profit/loss since strategy start. More... | |

| POSITION::state | position_state () const |

| Returns the position state. Possible values are: More... | |

| bool | is_long (void) const |

| Returns true if the position is 'long'. More... | |

| bool | is_short (void) const |

| Returns true if the position is 'short'. More... | |

| bool | is_flat (void) const |

| Returns true if the position is 'flat'. More... | |

| quantity_t | position_size (void) const |

| Returns the size of the position. More... | |

| position_t | position (void) const |

| Returns the current position. A negative number denotes a 'short' position. More... | |

Current Trade Metrics | |

| size_t | trade_leg_count (void) const |

| Returns the number of 'legs' in the current trade. A 'leg' is a change in position such as an 'add on' or 'partial exit', including the initial trade entry leg and final trade exit leg. More... | |

| double | trade_PL (void) const |

| Returns the profit/loss of the current trade. More... | |

| size_t | trade_bar_count (void) const |

| Returns the number of bars since the trade's first transaction. Returns 0 if the current position is flat. More... | |

| double | trade_first_leg_entry_price (void) const |

| Returns the price of the trade's first transaction (first leg). Returns 0 if current position is flat. More... | |

| const date_time & | trade_first_leg_entry_timestamp (void) const |

| Returns the timestamp of the trade's first transaction. More... | |

| quantity_t | trade_max_position (void) const |

| Returns the maximum position since the trade was initiated. A trade can have any number of 'add on' transactions and 'partial exits' and so the position size can vary over time. More... | |

| double | trade_most_favorable_price (void) const |

| Returns the most favorable price since the beginning of the trade. The trade may likely have been at its most profitable at that price, but not necessarily as this also depends on when 'add-on' transactions occurred and when 'partial-profit' was taken. More... | |

| double | trade_point_change_since_entry (void) const |

Transactions | |

| const transaction & | get_most_recent_transaction (void) const |

| int64_t | transact_count (void) |

| Returns the total number of transactions generated by the strategy so far. More... | |

| int64_t | transact_count (order::type order_type) |

| Returns the total number of transactions, for this instrument and for the given order type, generated since the beginning of the strategy. More... | |

| int64_t | unit_count (void) |

| Returns the total number of 'units' of this instrument traded since the beginning if the strategy. More... | |

Metrics | |

| const metrics & | get_metrics (void) const |

| Returns an instance of class metrics containing all metrics that describe this instrument's performance during simulation. Only call this member once the strategy has been finalized. More... | |

| virtual variant | get_metric (perf_metric_type metric_type, trade_grouping grouping=all_trades) const |

| Returns an individual metric value corresponding to the given metric_type and trade grouping. More... | |

| virtual variant | metric (const std::string &metric_name, trade_grouping grouping=all_trades) const |

| Returns an individual metric value corresponding to the given metric_name and trade grouping. More... | |

Class instrument represents a tradeable security such as a stock, option, futures contract, currency, etc. Class instrument combines data-access with functionality for placing orders and managing positions.

A single strategy can have any number of instrument members which allow it to trade pairs, baskets, and other instrument combinations. Data access is implemented by an internal in_stream member, which means that class instrument can be used in the same way as in_stream objects for receiving streaming data. Use instrument objects when you need to place orders relating to a particlar record stream, and use in_stream members to receive complementary data, such as company fundamentals, macroeconomic timeseries, or any other relevant data.

During strategy simulations each instrument object retains a history of all trades, which are used to product various reports once the strategy is finalized. The trade history can also be accessed as part of strategy evaluation.

Please refer to the TS-API User Guide and corresponding tutorials for information on how to best use class instrument.

| void tsa::instrument::allow_null_values | ( | bool | flag | ) |

Determines whether any incoming stream data is allowed to have 'null' ('N/A') values. If set to true, it is up to the user to explicitly check each value before using it. To check for null, values must be accessed as variants, not via auto-series. Use the variant::defined() member do check if the value is not null.

| flag | If true, allows incoming values to be 'null'. |

| bool tsa::instrument::allow_null_values | ( | void | ) | const |

Returns true if 'null' values are allowed in incoming stream data.

| void tsa::instrument::as_random_walk | ( | duration | bar_duration = duration::days(1) | ) |

Tells the instrument to generate its own random walk sequence with intervals of bar_duration.

The internal random walk generator generates data for the following fields:

| bar_duration | The duration between the timestamps of consecutive bars. |

| date_time tsa::instrument::begin | ( | void | ) |

Returns the timestamp of the first record in the datasource to which this object is connected.

Note that returning this value is only possible if the stream object is connected to a database table. A live data feed is not considered to have a beginning.

| double tsa::instrument::big_point | ( | void | ) | const |

The value (in local currency) of a 1 point change in the instrument's price. This calculated as follows: big_point_value = (1.0 / min_tick) * tick_value;.

| instrument & tsa::instrument::broker | ( | const std::string & | broker_name | ) |

Same functionality as platform(const std::string& platform_name) member.

| broker_name | Name of the broker. |

| order_ref tsa::instrument::buy | ( | quantity_t | quantity | ) |

Creates and immediately sends an order to buy 'at market' a given quantity of securities.

| quantity | The quantity. |

| order_ref tsa::instrument::buy_limit | ( | quantity_t | quantity, |

| double | limit_price | ||

| ) |

Creates and immediately sends an order to buy a given quantity of securities at a the given limit_price.

| quantity | The quantity. |

| limit_price | The limit price. |

| order_ref tsa::instrument::buy_limit_order | ( | quantity_t | quantity, |

| double | limit_price | ||

| ) |

Creates, without sending, an order to sell at given limit_price a given quantity of securities.

| quantity | The quantity. |

| limit_price | The limit price. |

| order_ref tsa::instrument::buy_order | ( | quantity_t | quantity | ) |

Creates an order, without sending it, to buy 'at market' a given quantity of securities.

| quantity | The quantity. |

| order_ref tsa::instrument::buy_stop | ( | quantity_t | quantity, |

| double | stop_price | ||

| ) |

Creates and immediately sends an order to buy a given quantity of securities at a the given stop_price.

| quantity | The quantity. |

| stop_price | The stop price. |

| order_ref tsa::instrument::buy_stop_limit | ( | quantity_t | quantity, |

| double | stop_price, | ||

| double | price_limit | ||

| ) |

Creates and immediately sends an order to buy a given quantity of securities at the given stop_price with the given price_limit.

| quantity | The quantity. |

| stop_price | The stop price. |

| price_limit | The price limit. |

| order_ref tsa::instrument::buy_stop_limit_order | ( | quantity_t | quantity, |

| double | stop_price, | ||

| double | price_limit | ||

| ) |

Creates, without sending, an order to buy a given quantity of securities at the given stop_price with given price_limit.

| quantity | The quantity. |

| stop_price | The stop price. |

| price_limit | The price limit. |

| order_ref tsa::instrument::buy_stop_order | ( | quantity_t | quantity, |

| double | stop_price | ||

| ) |

Creates, without sending, an order to buy a given quantity of securities at the given stop_price.

| quantity | The quantity. |

| stop_price | The stop price. |

| void tsa::instrument::cancel_order | ( | identifier_t | id | ) |

Cancels the order with t given order id.

| id | The order identifier. |

| void tsa::instrument::commission | ( | double | comm | ) |

Sets the per-side / per-unit commission. Commission is allocated on a per-unit basis (the default) or on a per-transaction basis depending on what was set via the cost_allocation() member.

| comm | The per-side commission. |

| double tsa::instrument::commission | ( | void | ) | const |

Returns the value set via the instrument::commission(double) member which is zero by default.

| void tsa::instrument::connect | ( | const std::string & | stream_name, |

| const std::string & | database_name = "default" |

||

| ) |

Sets the given stream as the instrument's data source.

This member function will seek to open the stream by reading from the data_base with the given data_base_name.

| stream_name | Name of the stream. |

| database_name | Name of the database. |

| void tsa::instrument::cost_allocation | ( | cost_alloc_type | t | ) |

Sets the cost-allocation type that affects how commission and slippage are accounted for during simulations. Valid values are:

| t | The cost_alloc_type. |

| bool tsa::instrument::costs_allocated_per_unit | ( | void | ) | const |

Returns true if the cost allocation is set to 'per_unit' (the default). Returns false if 'per_transaction'.

| instrument & tsa::instrument::currency | ( | const std::string & | ccy | ) |

Sets the instrument's currency.

| ccy | The ccy. |

| const std::string & tsa::instrument::currency | ( | void | ) | const |

Returns the instrument's currency.

| double tsa::instrument::current_drawdown | ( | void | ) | const |

Returns the size of the current equity drawdown for this instrument. If the strategy trades multiple instruments then each instrument will have its own drawdown measure.

| const std::vector< trade_leg > & tsa::instrument::current_trade_legs | ( | void | ) | const |

Returns a container with the current trade's 'legs'.

An open trade has at least one 'leg' that opened the trade, and any number of additional legs that increase of reduce the trade's position until the trade is closed out.

| void tsa::instrument::default_time_in_force | ( | order::time_in_force | default_tif | ) |

Sets the default time-in-force, which determines order lifetime.

| default_tif | the time in force. |

| instrument & tsa::instrument::define | ( | const std::string & | symbol, |

| const std::string & | exchange, | ||

| const std::string & | platform | ||

| ) |

Use this member to identify the instrument. This is required for live trading via the server.

| symbol | The symbol or symbol expiry combination such as: 'IBM', 'ES:DEC15', ESZ15'. |

| exchange | The exchange such as 'GLOBEX', 'NYSE'. If using Interactive Brokers 'SMART' exchange, then you must also set the currency like so: 'SMART:USD'. |

| platform | The platform such as 'IB' for Interactive Brokers. |

| date_time tsa::instrument::end | ( | void | ) |

Returns the timestamp of the last record in the datasource to which this object is connected.

Note that returning this value is only possible if the stream object is connected to a database table. A live data feed is not considered to have an ending.

| instrument & tsa::instrument::exchange | ( | const std::string & | exch | ) |

Sets the instrument's exchange. Use the define() member instead unless there is a special requirement.

| exch | The exchange. |

| const std::string & tsa::instrument::exchange | ( | void | ) | const |

Returns the instrument's exchange.

| instrument & tsa::instrument::expiry | ( | const std::string & | expiry | ) |

Sets the contract expiry. Use the define() member instead to pass a symbol-expiry combination like 'ES:DEC15', unless you have a special requirement.

| expiry | The expiry. |

| const std::string & tsa::instrument::expiry | ( | void | ) | const |

Returns the contract expiry like 'DEC15'.

| const std::string & tsa::instrument::expiry_yyyymm | ( | void | ) | const |

Returns the contract expiry in yyyymm format like: 201512.

| std::string tsa::instrument::feed | ( | void | ) | const |

Returns the name of the data feed to which the instrument is connected.

| size_t tsa::instrument::field_count | ( | void | ) | const |

Returns the number of fields in records streamed from the connected datasource.

| bool tsa::instrument::field_exists | ( | const std::string & | field_name | ) | const |

Returns true if a field with the given field_name exists in records coming from the data-source.

| field_name | The field/column name. |

| size_t tsa::instrument::field_index | ( | const std::string & | field_name | ) | const |

Return the zero based position of the field that has the given field_name.

| field_name | The field name. |

| tsa::type_t tsa::instrument::field_type | ( | const std::string & | field_name | ) | const |

Returns the field type of the field with the given field_name.

| field_name | Name of the field. |

| void tsa::instrument::get_active_orders | ( | std::vector< order_ref > & | v, |

| order::type | _ot, | ||

| order::action | _at | ||

| ) | const |

Populates vector v with all 'active' orders.

| [in,out] | v | The std::vector<order_ref>& to process. |

| _ot | The ot. | |

| parameter3 | The third parameter. |

| const std::vector< transaction > & tsa::instrument::get_bar_transactions | ( | void | ) | const |

Returns a reference to a vectors containing the transactions that occured during the current bar.

|

virtual |

Returns an individual metric value corresponding to the given metric_type and trade grouping.

| metric_type | Type of the metric. |

| grouping | Type of the aggregation. |

Implements tsa::metrics_source.

| const metrics & tsa::instrument::get_metrics | ( | void | ) | const |

Returns an instance of class metrics containing all metrics that describe this instrument's performance during simulation. Only call this member once the strategy has been finalized.

| order_ref tsa::instrument::get_order | ( | identifier_t | id | ) | const |

| order * tsa::instrument::get_order_ptr | ( | identifier_t | id | ) | const |

Returns a pointer to the order with given id. Note that it is unusual to access an order object directly. Normally orders should be handled via order_ref objects.

| id | The identifier. |

| void tsa::instrument::get_orders | ( | std::vector< order_ref > & | v, |

| bool | active_only = true |

||

| ) | const |

Populates vector v with either all or only the 'active' orders depending on the given active_only flag.

| [in,out] | v | The std::vector<order_ref>. |

| active_only | flag. |

| bool tsa::instrument::has_active_orders | ( | void | ) | const |

Checks if this instrument object has 'active' orders.

| std::string tsa::instrument::instrument::type | ( | void | ) | const |

Returns the instrument type like 'STK' or 'FUT'.

| std::string tsa::instrument::interval | ( | void | ) | const |

Returns the interval (bar) type and duration. Valid values look like '5MIN', '1SEC', '3TICK'.

| bool tsa::instrument::is_flat | ( | void | ) | const |

Returns true if the position is 'flat'.

| bool tsa::instrument::is_live | ( | void | ) | const |

Strategies driven by 'live' data can be started on 'backfill' data. Once the strategy has worked through the backfill records, it calls strategy::on_live() from which point onward the strategy switches to 'live' data and instrument::is_live() returns true.

| bool tsa::instrument::is_long | ( | void | ) | const |

Returns true if the position is 'long'.

| bool tsa::instrument::is_platform_driven | ( | void | ) | const |

Returns true if the strategy is attached to a platform_proxy or net::socket_base derived object.

If the strategy is platform driven, all orders and data requests are forwarded to the attached object.

| bool tsa::instrument::is_short | ( | void | ) | const |

Returns true if the position is 'short'.

| void tsa::instrument::limit_fill_proviso | ( | double | proviso | ) |

Sets the 'limit fill proviso'. This value determines by what margin market prices must exceed a limit price for a limit order to be assumed filled as part of a simulation. This value can help make simulations more realistic.

The execution of 'limit orders' on an exchange is not guaranteed. In some cases a 'limit order' may be filled when traded prices 'hit' the limit price. However, in practice, it is likely that the traded price needs to move one tick past the limit price before a 'limit order' can be assumed to have been filled!

By default, this 'proviso' value is zero. With a setting of zero, prices must only move 'beyond' the limit price, no matter by how small an amount ( at leat 10e-9) for the limit order to be considered filled.

If the 'limit_fill_proviso' is, for example, set to 1.0, then, in the case of a limit sell order, traded prices must move below the limit price by more than 1.0.

Note that it is possible to reset the limit-fill-proviso while a strategy simulation is underway.

Note that the size of a single tick is not constant when dealing with price series that have been dividend-adjusted, split-adjusted, or roll-over adjusted. So adjusting the limit-fill- proviso throughout the simulation may be required for realistic simulation.

| proviso | The limit-fill-proviso. |

| double tsa::instrument::limit_fill_proviso | ( | void | ) | const |

Returns the 'limit fill proviso'.

|

virtual |

Returns an individual metric value corresponding to the given metric_name and trade grouping.

| metric_name | Name of the metric. |

| grouping | The grouping. |

Implements tsa::metrics_source.

| void tsa::instrument::name | ( | const std::string & | name | ) |

Sets the instrument name.

The instrument name is intended to help identify instruments on reports. An instrument name must be unique to a strategy. Naming an instrument is not mandatory as each instrument is otherwise automatically assigned a default name, usually based on the name of the stream to which the instrument is connected.

| name | The instrument name. |

| const std::string & tsa::instrument::name | ( | void | ) | const |

Returns the instrument name.

| void tsa::instrument::negative_prices_ok | ( | bool | neg_prices_ok | ) |

Sets a flag which if 'true' allows negative prices in fields 'open', 'high', 'low', 'close'.

By default prices at or below 0.0 are not allowed during simulations as some indicators and calculations may not be able to handle negative numbers or changes from positive to negative (such as indicators calculating percentage changes). If the flag is left as false, an exception will be thrown in case of violation.

| neg_prices_ok. |

| bool tsa::instrument::negative_prices_ok | ( | void | ) | const |

Returns true if negative prices are tolerated during strategy evaluation.

| double tsa::instrument::net_profit | ( | void | ) | const |

Returns the cumulative net profit/loss since strategy start.

| const series_core & tsa::instrument::operator() | ( | size_t | field_pos | ) | const |

From records streamed from the data source this member returns the series corresponding to the given field_pos.

| field_pos | The column/field position. |

| const series_core & tsa::instrument::operator() | ( | const std::string & | field_name | ) | const |

From records streamed from the data source this member returns the series corresponding to the given field_name.

| field_name | Name of the column/field. |

| size_t tsa::instrument::order_count | ( | void | ) | const |

Returns the number of 'active' orders.

| size_t tsa::instrument::order_count_inclusive | ( | void | ) | const |

Returns the number of orders, both 'active' and 'inactive'. Inactive orders may be marked for deletion.

| bool tsa::instrument::order_exists | ( | identifier_t | id | ) | const |

Returns true if an order with the given id exists.

| id | The identifier. |

| instrument & tsa::instrument::platform | ( | const std::string & | platform_name | ) |

Sets the name of the excution platform / broker. Note that different instrument objects can trade via different brokers.

| platform_name | The name. |

| position_t tsa::instrument::position | ( | void | ) | const |

Returns the current position. A negative number denotes a 'short' position.

| quantity_t tsa::instrument::position_size | ( | void | ) | const |

Returns the size of the position.

| POSITION::state tsa::instrument::position_state | ( | ) | const |

Returns the position state. Possible values are:

| date_time tsa::instrument::record_timestamp | ( | void | ) | const |

Returns the timestamp of the current record.

Note that this timestamp normally corresponds to the timestamp of the current strategy- interval, as returned by the strategy::timestamp() member. In case the underlying data source has no record for the current strategy interval then the value returned by this member will not match the value returned by strategy::timestamp(). This may happen for example when working with multiple data streams of different timescales.

| order_ref tsa::instrument::sell | ( | quantity_t | quantity | ) |

Creates and immediately sends an order to sell 'at market' a given quantity of securities.

| quantity | The quantity. |

| order_ref tsa::instrument::sell_limit | ( | quantity_t | quantity, |

| double | limit_price | ||

| ) |

Creates and immediately sends an order to sell at given limit_price a given quantity of securities.

| quantity | The quantity. |

| limit_price | The limit price. |

| order_ref tsa::instrument::sell_limit_order | ( | quantity_t | quantity, |

| double | limit_price | ||

| ) |

Creates, without sending, an order to sell at given limit_price a given quantity of securities.

| quantity | The quantity. |

| limit_price | The limit price. |

| order_ref tsa::instrument::sell_order | ( | quantity_t | quantity | ) |

Creates, without sending, an order to sell 'at market' a given quantity of securities.

| quantity | The quantity. |

| order_ref tsa::instrument::sell_stop | ( | quantity_t | quantity, |

| double | stop_price | ||

| ) |

Creates and immediately sends an order to sell a given quantity of securities at a the given stop_price.

| quantity | The quantity. |

| stop_price | The stop price. |

| order_ref tsa::instrument::sell_stop_limit | ( | quantity_t | quantity, |

| double | stop_price, | ||

| double | price_limit | ||

| ) |

Creates and immediately sends an order to sell a given quantity of securities at the given stop_price with the given price_limit.

| quantity | The quantity. |

| stop_price | The stop price. |

| price_limit | The price limit. |

| order_ref tsa::instrument::sell_stop_limit_order | ( | quantity_t | quantity, |

| double | stop_price, | ||

| double | limit_price | ||

| ) |

Creates, without sending, an order to sell a given quantity of securities at the given stop_price with given price_limit.

| quantity | The quantity. |

| stop_price | The stop price. |

| limit_price | The limit price. |

| order_ref tsa::instrument::sell_stop_order | ( | quantity_t | quantity, |

| double | stop_price | ||

| ) |

Creates, without sending, an order to sell a given quantity of securities at the given stop_price.

| quantity | The quantity. |

| stop_price | The stop price. |

| void tsa::instrument::set_next_bar | ( | const date_time & | _ts, |

| double | o, | ||

| double | h, | ||

| double | l, | ||

| double | c, | ||

| double | v | ||

| ) |

Manually sets the next bar timestamp and ohlcv prices. Useful for writing test code.

| parameter1 | The first parameter. |

| o | open price. |

| h | high price. |

| l | low price. |

| c | close price. |

| v | volume. |

| void tsa::instrument::slippage | ( | double | slip | ) |

Sets the 'per side' or 'per transaction' slippage (by default it is interpreted as 'per-side' slippage. This can be changed via the cost_allocation() member). A realistic slippage setting helps make simulations more realistic by accounting for non-optimal fills. Slippage is only counted for stop and market orders. Limit orders never have slippage regardless of the slippage setting. Slippage can be reset during strategy evaluations to account for changes in volatility.

| slip | The value. |

| double tsa::instrument::slippage | ( | void | ) | const |

Returns the slippage as set via the slippage(double slip) member.

| std::string tsa::instrument::stream_name | ( | void | ) | const |

Returns the name of the data stream to which the instrument is connected.

| instrument & tsa::instrument::symbol | ( | const std::string & | symb | ) |

Sets the instrument's symbol. Use the define() member instead unless you have a special requirement.

| symb | The symbol. |

| void tsa::instrument::tick | ( | double | min_tick, |

| double | tick_value, | ||

| bool | auto_round = true |

||

| ) |

Sets the value of the 'minimum tick' (the smallest possible price change for a given traded security) as well as the tick's cash value.

The default min_tick value is 0.01 points and a corresponding tick_value of 0.01 (local currency). This works fine for most traded stocks, but does not work for futures, options and other products.

The auto_round argument determines whether the system will automatically round stop and limit order prices passed to order functions (e.g instrument::buy()). Note that when working with split adjusted stock price series, the historical minimum tick is no longer accurate and you may need to disable automatic rounding.

| min_tick | The minimum tick. |

| tick_value | The tick value in the currency in which the instrument is traded. |

| auto_round | true to automatically round. |

| double tsa::instrument::tick_size | ( | void | ) | const |

Returns the value of the smallest allowed price change (min_tick) as set via the tick() member.

| double tsa::instrument::tick_value | ( | void | ) | const |

Returns the cash value of the min_tick as set by via the tick() member.

By default the tick value is set to 0.01.

| double tsa::instrument::ticks | ( | int64_t | multiplier | ) | const |

Returns the price equivalent of a price tick multiplied by the given multiplier.

The tick value is either the default 0.01 or was previously set via instrument::tick(). This function is useful for adding a certain number of ticks to a price, to be used as stop or limit price in a trading scenario.

| multiplier | The tick multiplier. |

| size_t tsa::instrument::trade_bar_count | ( | void | ) | const |

Returns the number of bars since the trade's first transaction. Returns 0 if the current position is flat.

| double tsa::instrument::trade_first_leg_entry_price | ( | void | ) | const |

Returns the price of the trade's first transaction (first leg). Returns 0 if current position is flat.

| const date_time & tsa::instrument::trade_first_leg_entry_timestamp | ( | void | ) | const |

Returns the timestamp of the trade's first transaction.

| size_t tsa::instrument::trade_leg_count | ( | void | ) | const |

Returns the number of 'legs' in the current trade. A 'leg' is a change in position such as an 'add on' or 'partial exit', including the initial trade entry leg and final trade exit leg.

| quantity_t tsa::instrument::trade_max_position | ( | void | ) | const |

Returns the maximum position since the trade was initiated. A trade can have any number of 'add on' transactions and 'partial exits' and so the position size can vary over time.

| double tsa::instrument::trade_most_favorable_price | ( | void | ) | const |

Returns the most favorable price since the beginning of the trade. The trade may likely have been at its most profitable at that price, but not necessarily as this also depends on when 'add-on' transactions occurred and when 'partial-profit' was taken.

| double tsa::instrument::trade_PL | ( | void | ) | const |

Returns the profit/loss of the current trade.

| int64_t tsa::instrument::transact_count | ( | void | ) |

Returns the total number of transactions generated by the strategy so far.

| int64_t tsa::instrument::transact_count | ( | order::type | order_type | ) |

Returns the total number of transactions, for this instrument and for the given order type, generated since the beginning of the strategy.

| order_type | The type. |

| int64_t tsa::instrument::unit_count | ( | void | ) |

Returns the total number of 'units' of this instrument traded since the beginning if the strategy.